Financial Information

As you may be aware the level of Government funding towards the costs of running schools has remained relatively unchanged in recent years while our costs have increased.

It’s that time of the year when we ask you to invest in your child’s future through making a valuable contribution by way of your Donation to the School. Much of the equipment and resources we provide here at Brooklyn are not covered by government funding. We rely heavily on the generosity of our parent community to continue to provide the exceptional level of education and experiences that we provide at Brooklyn School.

Your donation helps pay for:

Additional learning support hours. Your donations make it possible to employ more staff to help tamariki learn and provide extra support.

Funding a literacy specialist to support the reading and writing for those needing this.

New reading books for our tamariki to use in classrooms to support their learning.

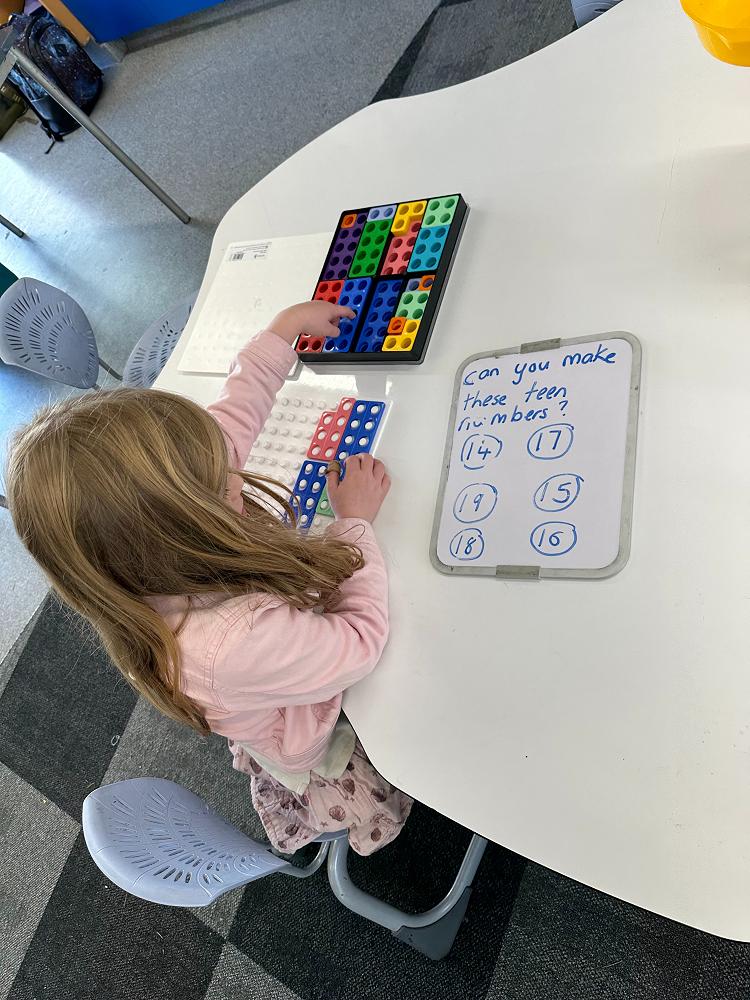

New Maths resources to help support our tamariki in maths as we deliver the refreshed maths and statistics curriculum.

Range of consumable items for classrooms and the Library.

Chromebooks for use by students who do not own a device or their device is undergoing repairs

Equity/Hardship support for families, i.e. extracurricular activities.

While the donations are voluntary, we encourage you to make this investment in your child’s education. The donation will be listed in your statement of account.

Donations are tax deductible, and any payments made can be claimed in the current tax year.

If you are unable to pay the full amount you are welcome to make a smaller donation or contact Liz Rhodes, our Principal, or our Board of Trustees Presiding Member via the school office to discuss alternative ways to contribute to the school.

Thank you for your support.

The Board of Trustees has set the school donation rates for 2025 as follows:

Family with 1 child at school $280 per year (or $70 per term)

Family with 2 children at school $560 per year (or $140 per term)

Family with 3 children at school $810 per year (or $202.50 per term)

Receipts will be issued for donations, and tax rebates can be claimed from the Inland Revenue Department.

Payment Options

Option 1 – one lump sum at the start of the year (our preferred option)

Option 2 – four equal instalments during the year (1 instalment per term)

Option 3 – weekly, fortnightly or monthly instalments

Please contact our accounts department to discuss this option. Please email accounts@brooklynprimary.school.nz

Payment Methods

Our preferred method of payment is direct Internet Banking to the school, as this does not incur any additional costs to you or the school. Another way is via

Eftpos at the school office.

NB: Our aim is to be cashless as much as possible, although should you have no option but to pay with cash, please place the cash into a clearly named envelope with your child’s name, teacher name, date and what you are paying for.

Brooklyn School Direct payment details /Internet Banking

Bank Account Name: Brooklyn School Board of Trustees

Bank: (ASB)

Bank Account Number: 12-3141-0139800-00

Please include your child's initials and surname plus what you are paying for in the reference eg - Donation, Sports, bus etc

How to claim your rebate

Because your payment is a donation, you are entitled to receive a rebate of 33% (payment for trips, activities and Year 7/8 technology are not eligible for this rebate).

To claim this rebate, save all your voluntary donation receipts for the tax year (1 April -31 March) and send them into the IRD along with a completed rebate claim form (IR 526) for that year.

To obtain a copy of the rebate claim form

Go to the Inland Revenue website

Go to the Forms & Guides section (lower right hand side)

Categorise the forms by number, and locate the IR 526 form. This form can be downloaded and printed out. You can also contact the IRD by phoning 0800 257 773 & following the prompts. Your IRD number will be required.

You may also be able to claim childcare costs (such as Pridelands), using the same forms. Information can be found on the IR 525 facts sheet.

Send the completed form, with all receipts to: Inland Revenue, PO Box Box 39090, Wellington Mail Centre, Lower Hutt 5045.

Your refund should be received within 6 weeks of lodging your claim.

Student Statements

Student statements are sent out via our SMS (Student Management System) HERO, each month, during term time.

Your child's account can be viewed at any time via HERO.

Account enquires

For enquires regarding your child's account, please contact Jo Henley on -accounts@brooklynprimary.school.nz.

Year 7 & 8 Enrichment Programme

Our senior students (Year 7 & 8)are required to pay an additional $140 per annum to help offset costs of the enrichment programme.

The enrichment programme takes place at Mt. Cook School, Te Aro, Wellington.

These costs include bus transport to Mt Cook school, materials and staff.

Please see attachment below to find out more about the programme.

It would be appreciated if the Technology Fee was paid in full by the end of Term 2.