NZ's Economic Outlook

This article is a snippet from Tony Alexander's popular weekly economic commentary piece called Tony's View. Sign up for free at www.tonyalexander.nz

Let’s start this week’s TV with a run-through of some of the latest information we have relevant to prospects for the NZ economy. In doing this we have to keep in mind the negative distortion which arises from Alert levels 4 and 3, and the positive distortion which then comes as we are freed and catch up on delayed buying of consumer goods, services, and each other’s houses.

Household spending

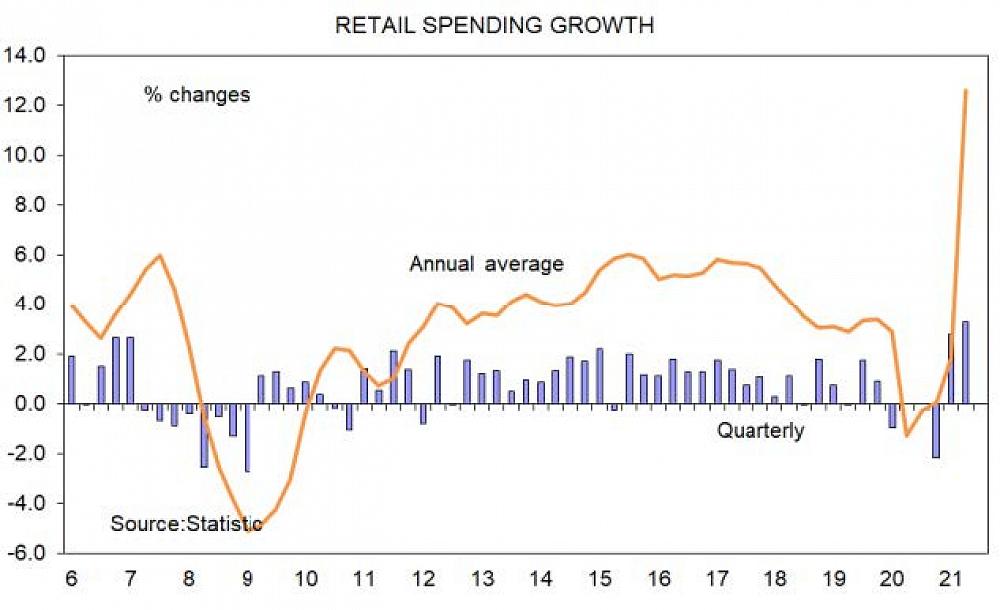

What do we know about the biggest driver of changes in the strength of our economy – household spending? Ahead of lockdown things were going very strongly. The volume of spending on retail goods and services which you and I do as consumers rose in seasonally adjusted terms by 3.4% in the three months ending in June. This followed a rise of 2.8% in the March quarter, making for a very strong first half of this year.

This graph shows the annual average pace of change in retail spending volumes as the orange line and the columns in blue show quarterly changes. The columns illustrate the relative strength of recent spending growth. I have stripped out the big 16% fall in the June quarter last year then the big rise of 28% in the September quarter to make the recent strength easier to see on the right hand side.

Consumer spending growth is good. Will it stay this way? No.

Rising interest rates

Interest rates are set to rise and that will eventually force people with large mortgages to cut back on both discretionary spending (eating out) and purchases of large items like cars and couches. The main impact is likely through 2023.

Travel opportunities to return

People engaged in a lot of catch-up spending following last year’s lockdown and brought forward in time a lot of spending they would otherwise have done some time down the track. Why? Because of an inability to travel offshore thus a reallocation of one’s travel budget to other things.

Now, people have extra spas and kayaks and won’t need to buy such things again for a number of years. Stores which have seen sales boom post-May 2020 are going to see some easing over the next couple of years. Picking which stores feel this first and by how much is however impossible.

Slower labour supply growth

Jobs growth has been a good 1.7% in the past year and labour demand remains very strong. But the people are not there to be newly hired and the government is going to restrict working migrant inflows once the borders open up. So, while job security and wages will rise and support more household spending, the net number of people newly working may show slower growth.

OE catch-up

With regard to borders and migration, once the gates open we are likely to see an outflow of Kiwis to other parts of the world. There will be two years worth of OE to catch up on. Also a lot of people are likely to move to Australia as labour demand is strong there and we Kiwis traditionally shift across the Tasman when jobs in Oz are plentiful.

Slowing wealth growth

There will be some support for household spending growth from higher housing wealth. But whatever the spending driven by rising house prices has been in the past year, it won’t be as strong in the coming year. That is because house price growth is going to slow from 30% towards 10%.

Support from bigger bank balances

There will also be some support from the extra near $10bn which householders have sitting in their bank accounts over and above what would have been there without the global pandemic.

Furnishing of new houses

Some support also will come from record levels of house construction with which there will be associated a traditional lift in spending on furniture and things for completing a new home.

The various forces in play suggest good growth in household spending. But four factors will eventually constrain then weaken sales in durable items like furniture.

1. Rising interest rates.

2. A switch in conversation next year to brain drain rather returning Kiwis.

3. Diversion of funds back to offshore travel.

4. A reversal of the past year’s unsustainable binge on spa pools and suchlike.

For the moment, interesting as I always find the results in my monthly Spending Plans Survey, I’m not willing to extrapolate the big reductions in intentions of spending across most (not all) items. There is clearly a downward bias in play from the lockdown and we will get a better feel of underlying spending plans from the next survey in four weeks.

Exports

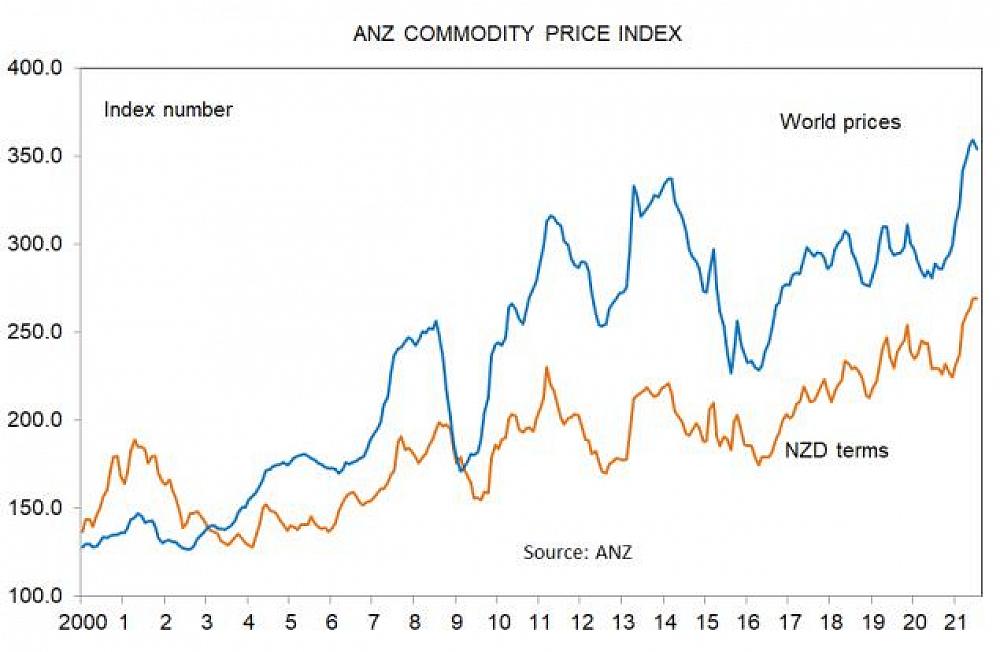

The next change in our borders will be an opening up, and that means for calendar 2022 we can reasonably anticipate higher receipts for inward tourism and export education. This will assist growth in the overall economy.For the primary sector, the forward indicators are good. The prices which we are receiving for the usually minimally-processed commodities which we ship offshore are quite strong. The ANZ Commodity Price Index in world price terms is sitting 18% higher than at the end of 2019. In NZ dollar terms the gain is 13%.

Forecasts for growth in our trading partners have been pared back slightly recently in the face of concerns about the Delta variant of Covid-19. But the world will shift from locking down to contain the speed of spread towards opening up with increased vaccination, and this will allow growth to continue – eventually.

One source of restraint on the pace of growth in our export receipts will be disruptions in global supply chains. Lack of air freight capacity is hitting some exporters, lack of timely or sufficient delivery of some imported inputs is constraining some export volume growth. In addition, high and still rising transport costs are reducing export viability for some producers.

There is no reason for believing that a fresh surge in export receipts will occur over the next three years. But improving world growth – in fits and starts – tends always to produce benefits for New Zealand’s export-dependent economy.

Business Investment

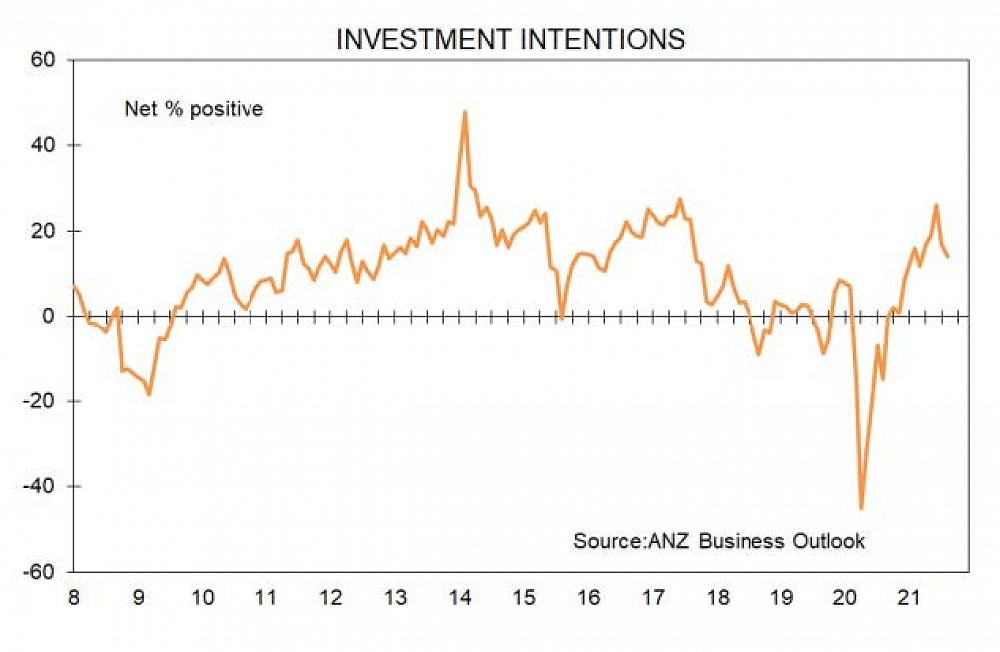

The key reason why productivity growth is low in New Zealand (not absolute productivity related to small market size and distance from other economies) is weak business capital spending. The size of the stack of equipment, technology etc. which each Kiwi worker has is smaller than workers in many other countries.

Boosting productivity in New Zealand will require a combination of higher capital spending, and inefficient businesses closing down to free up resources for higher profit enterprises. The leading indicators for investment look good. In the ANZ Business Outlook Survey a net 14% of businesses early in August said that they intend boosting their investment levels. This was almost twice the ten-year average of a net 8% positive.

A key factor driving higher capex is that businesses can no longer comfortably find the staff they need. In order to grow capacity they have no option other than to boost productivity of their existing labour resource.

Residential construction

House building usually accounts for about 6% of activity in the New Zealand economy and this is associated with consent numbers averaging about 0.6% of the population. With consent numbers now above 45,000 from 37,000 just before lockdown last year, the proportion is about 0.9%. House building activity is contributing about 3% more per annum to the economy than would normally be the case.

The number of consents being issued for new dwellings to be built continues to rise. Therefore the house building sector will help drive growth in the economy over at least the next couple of years.

However, the current level of construction is not sustainable in light of a projected slowing in the country’s population growth rate from just under 50% in the past three decades to 27% in the next three decades.At some stage, perhaps 3-5 years from now, house building activity is likely to undergo a correction downward. But until then, the sector will be a key factor behind our economy continuing to have good growth.

Fiscal policy

There is little pressure on the NZ government to rein in spending. No credit rating agencies have expressed concern about NZ debt levels as we have a record of good fiscal management since the early-1990s and because our debt numbers are much better than those elsewhere.

However, New Zealand faces a need for temporary stimulatory fiscal policy about once every ten years or so and the government will want to rebuild the fiscal buffer ready for the next shock within a decade. Therefore, a shift in fiscal policy stance towards mildly restraining economic activity is likely soon.

Prospects look good for the NZ economy. What is the main thing which could go wrong? Inflation – about which my opinion is there are upside risks which will cause interest rates to rise more than the 1.75% pencilled in by the Reserve Bank.

The assumption that inflation is above 3% only because of temporary factors loses power the longer those factors persist and when taken in the context of a structural tightening of the labour market which will boost the proportion of higher inflation which recycles into wages. Then the higher wages go into higher selling prices.